IronWeave Makes Real World Assets Real

Real World Assets (RWAs): The Bridge Between Traditional Finance and Web3

Let’s get real. Tokenized Real World Assets are one of the most tangible use cases that will gain adoption by the traditional worlds of both finance and business. But there are clear conditions that must be met for this to happen. That’s what we’re going to talk about in today’s blog.

What Are Real World Assets (RWAs)?

As we’ve mentioned in some of our earlier blogs, Real World Assets (RWAs) span a range of physical and financial assets that exist in the traditional economy but can now be represented and traded digitally using blockchain technology. These assets include:

- Real Estate – Commercial buildings, residential properties, land

- Commodities – Gold, silver, oil, agricultural products

- Private Credit & Loans – Bonds, mortgages, business loans

- Equities & Securities – Private equity, fractional ownership in businesses

- Luxury Goods – Art, collectibles, rare items

- Infrastructure – Energy projects, transportation networks

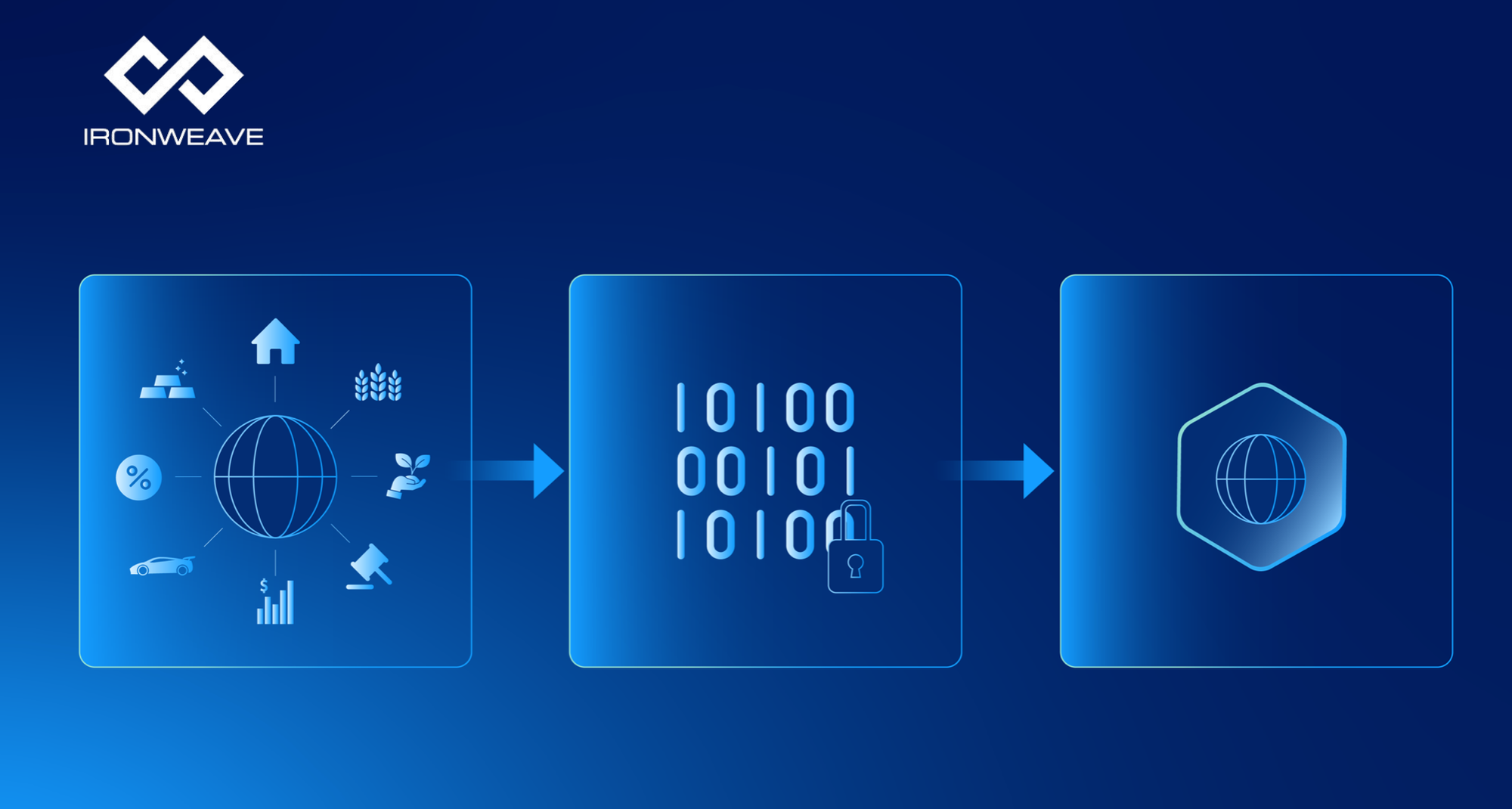

Tokenizing RWAs involves converting these assets into their digital representations on a blockchain. Once digitized as tokens, these assets are more liquid, i.e. easier to buy and sell, transparent (that’s good if that means auditable, bad if it means visible to anyone), and accessible to a global market.

Who Uses RWAs?

RWAs are a game-changer for their many market participants. RWAs aren’t just the latest cool tool. They open up financing opportunities for people and businesses who don't have access to capital, and they reduce costs by eliminating intermediaries. Who are the stakeholders eager to take advantage of this new asset class?

- Institutional Investors – Pension funds, asset managers, hedge funds looking for diversified and liquid investment options

- Retail Investors – Individuals gaining fractional ownership in previously inaccessible asset classes

- Businesses & Enterprises – Companies seeking alternative financing and streamlined asset management

- Governments & Regulators – Authorities exploring tokenized bonds, land registries, and transparent public funding mechanisms

- DeFi Platforms & Web3 Projects – Blockchain-based ecosystems integrating RWAs into lending, staking, and yield-generation strategies

Market Size & Growth Potential

As also mentioned in recent blogs, within five years the global market size of tokenized assets is projected to be between $16 trillion and $30 trillion dollars.

The tokenization of RWAs is projected to grow rapidly as financial markets recognize the benefits of increased liquidity, efficiency, and access to traditionally illiquid assets. Institutional adoption is accelerating with major players like BlackRock, JP Morgan, and Citi investing in tokenization initiatives.

Why Do Data Security & Privacy Matter?

While tokenization promises transparency and efficiency, it also introduces serious concerns about security and privacy:

- Data Integrity & Fraud Prevention – Ensuring that tokenized assets accurately represent their real-world counterparts and are not duplicated, altered, or manipulated.

- Privacy in Ownership & Transactions – Unlike traditional financial markets, public blockchains expose transaction details, which can compromise investor confidentiality and create security risks.

- Regulatory Compliance – Tokenized RWAs must meet stringent regulatory requirements around KYC (Know Your Customer), AML (Anti-Money Laundering), and data protection laws.

- Interoperability & Scalability – Many blockchain solutions struggle to balance privacy with compliance and cross-platform functionality.

Many companies are tokenizing assets on public chains, or hybrid public/private chains. None have been purpose built for privacy while also being auditable.

Without secure, private infrastructure, institutions will hesitate to bring RWAs on-chain, limiting their adoption and potential impact.

Why IronWeave Is the Best Solution for RWAs

IronWeave provides the secure, scalable, and privacy-focused infrastructure necessary for RWAs to thrive in both traditional finance and Web3 ecosystems.

✅ Private-Shared-Blocks (PSBs) – IronWeave’s unique architecture enables private transactions and ownership records while still allowing selective transparency for regulatory compliance.

✅ Tamper-Proof & Immutable – RWAs require a trustless system where records cannot be altered—IronWeave ensures verifiable, fraud-resistant transactions.

✅ Regulatory-Ready – Designed to integrate KYC/AML requirements without exposing sensitive financial data on public ledgers.

✅ Interoperability – Seamlessly connects with existing financial systems, enabling institutions to integrate RWAs without overhauling their infrastructure.

✅ High-Throughput, Low Cost – Unlike Ethereum-based solutions that struggle with gas fees and congestion, IronWeave provides scalable and cost-effective tokenization.

As financial institutions and DeFi platforms race to unlock the value of RWAs, IronWeave is the bridge that ensures security, privacy, and regulatory confidence—without sacrificing decentralization.

The future of RWAs isn’t just digital—it’s IronWeave-secured.