Institutional Adoption of Blockchain Technology: IronWeave Leads The Way

The Web3 community wants to be broadly respected and adopted. So far, traditional financial institutions have been slow to adopt blockchain technology. But there’s a clear path to acceptance.

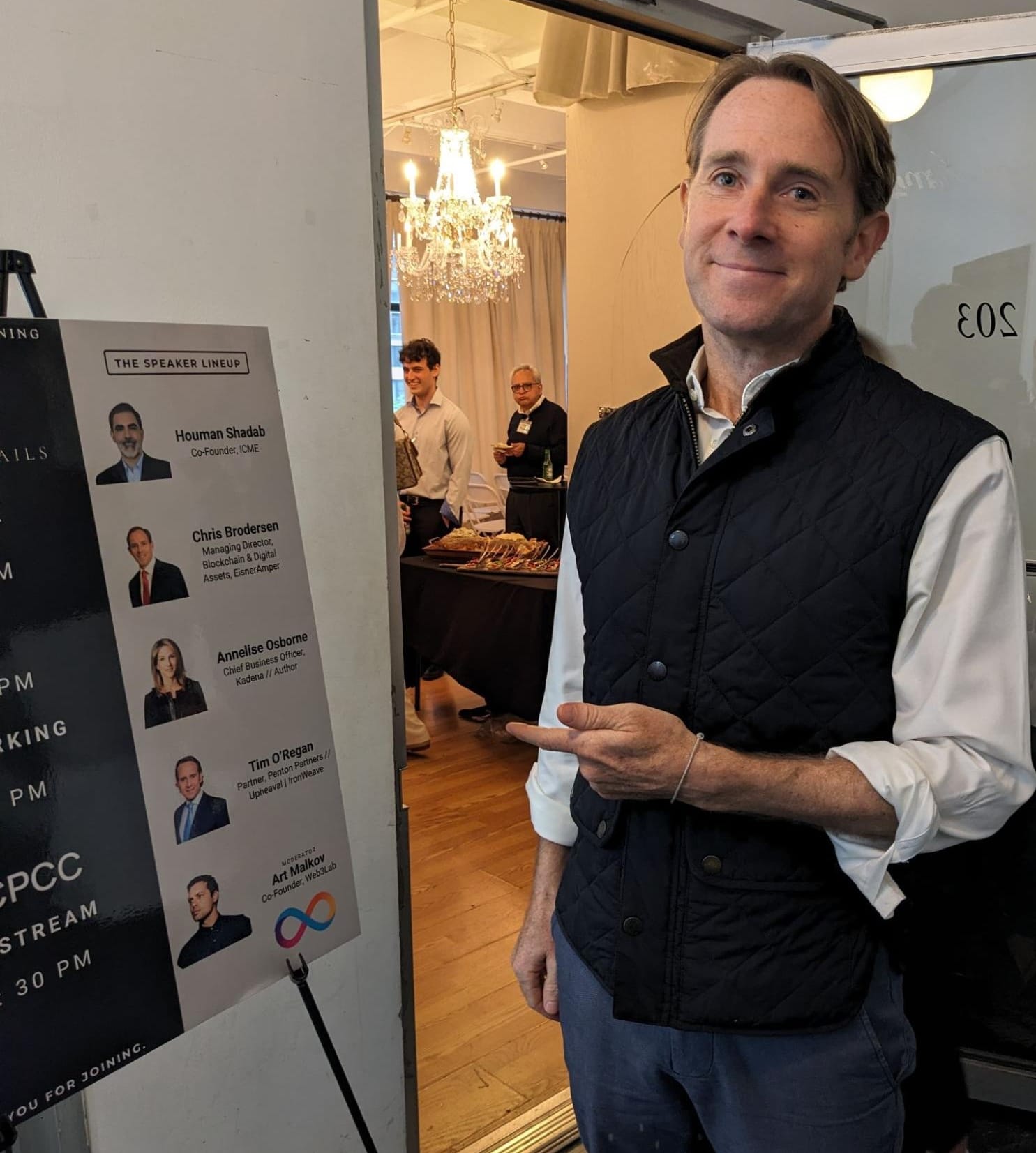

This past Friday, May 10th in midtown Manhattan, a group of blockchain and finance enthusiasts gathered for an insightful panel discussion on the adoption of blockchain technologies by traditional finance companies. The event explored a critical and timely topic: the synergy between digital assets, blockchain technology, and traditional finance.

Tim O’Regan, IronWeave’s co-founder, had the audience’s full attention as he described the innovation that IronWeave is bringing to the fore of global private payments. Bridging Web2 to Web3 has never been easier with IronWeave technology. You could see the heads of audience members nodding in understanding. They got it.

The Concept of Synergy in Blockchain and Finance

The term "synergy" often invokes skepticism, yet it perfectly encapsulates the evening’s discussion. True synergy refers to the interaction or cooperation between organizations or technologies that produce a combined effect greater than the sum of their individual effects. The panelists convincingly argued that integrating digital asset blockchain technology with traditional finance can indeed create value and impact far beyond what each could achieve alone.

Panelists and Their Contributions

ICP - Internet Computer Protocol

David Klein and Ryan Duffy hosted the event, representing ICP's vision of replacing most of the world's software with smart contracts. Their discussion focused on making smart contracts as powerful and functional as traditional software, highlighting the transformative potential of blockchain technology.

Panelists

Moderator: Art Malov, formerly Chief Marketing Officer of Polymarket, IoTeX and Zilliqa, currently co-founder of Lever.io social media influencer, advisor to the Columbia University Blockchain Accelerator, and a contributing writer for Forbes.

Tim O’Regan, Co-Founder of IronWeave, has deep experience in emerging markets funds, PE investments, startups, including crypto, and non-profits.

Tim, along with the other panelists, painted a picture of what is needed for institutional adoption of blockchain technology. His discussion covered critical aspects such as regulation, education, and accessibility. IronWeave’s decentralized infrastructure stands out from other chains by virtue of having no central ledger and independently encrypted blocks. This ensures unparalleled security and scalability. Their innovative approach addresses many limitations of traditional blockchain architectures and opens new possibilities for enterprise applications.

Annelise Osborne, Chief Business Officer at Kadena, L1 Blockchain

Annelise is the author of “From Hoodies to Suits: Innovating Digital Assets For Traditional Finance”, and brings a wealth of experience from her time at JP Morgan, where she contributed to the development of JPM Coin. She emphasized that blockchain technology and digital assets could make financial transactions more secure and efficient, with significant potential for increasing revenue and decreasing expenses.

Chris Brodersen, Managing Director at Eisner Amper’s Blockchain & Digital Assets Group

Chris discussed how his team helps businesses navigate the challenges of emerging technologies and digital assets. His insights focused on planning for growth and innovation in the blockchain space.

Insights from the Panel Discussion

Blockchain technology and digital assets offer the potential to make financial transactions much more secure and more efficient with possibilities to increase revenue and decrease expenses. Institutional players have already created use cases in money market funds, settlement and alternative investments.

- Annelise Osborne

These insights underscored the significant potential for blockchain technology to revolutionize traditional finance by enhancing security, efficiency, and scalability.

The Takeaway

The event highlighted the remarkable synergy possible between blockchain technology and traditional finance. By integrating digital assets with traditional financial systems, companies can achieve greater efficiency, security, and scalability. As the blockchain space continues to evolve, staying informed and considering its implications will be crucial for those in the financial industry.

Stay tuned for more insights and developments in this exciting field.